Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

1.

|

Most economists use the aggregate demand and aggregate supply model primarily to

analyze

a. | short-run fluctuations in the economy. | b. | the effects of macroeconomic policy on the

prices of individual goods. | c. | the long-run effects of international trade

policies. | d. | productivity and economic growth. |

|

|

|

2.

|

Which of the following typically rises during a recession?

a. | garbage collection | b. | unemployment | c. | corporate

profits | d. | automobile sales |

|

|

|

3.

|

Real GDP

a. | is the current dollar value of all goods produced by the citizens of an economy

within a given time. | b. | measures economic activity and

income. | c. | is used primarily to measure long-run changes rather than short-run

fluctuations. | d. | All of the above are correct. |

|

|

|

4.

|

The model of short-run economic fluctuations focuses on the price level

and

a. | real GDP. | b. | economic growth. | c. | the neutrality of

money. | d. | None of the above is correct. |

|

|

|

5.

|

The average price level is measured by

a. | any real variable. | b. | the rate of inflation. | c. | the level of the

money supply. | d. | the CPI or the GDP deflator. |

|

|

|

6.

|

The aggregate demand and aggregate supply graph has

a. | the price level on the horizontal axis. The price level can be measured by the

GDP deflator. | b. | the price level on the horizontal axis. The price level can be measured by real

GDP. | c. | the price level on the vertical axis. The price level can be measured by the

GDP deflator. | d. | the price level on the vertical axis. The price level can be measured by

GDP. |

|

|

|

7.

|

The aggregate-demand curve shows the

a. | quantity of labor and other inputs that firms want to buy at each price

level. | b. | quantity of labor and other inputs that firms want to buy at each inflation

rate. | c. | quantity of domestically produced goods and services that households want to buy at

each price level. | d. | quantity of domestically produced goods and

services that households, firms, the government, and customers abroad want to buy at each price

level. |

|

|

|

8.

|

Which of the following effects helps to explain the downward slope of the

aggregate-demand curve?

a. | the exchange-rate effect | b. | the wealth effect | c. | the interest-rate

effect | d. | All of the above are correct. |

|

|

|

9.

|

Changes in the price level affect which components of aggregate demand?

a. | only consumption and investment | b. | only consumption and net

exports | c. | only investment | d. | consumption, investment, and net

exports |

|

|

|

10.

|

Other things the same, an increase in the price level makes the dollars people

hold worth

a. | more, so they can buy more. | b. | more, so they can buy less. | c. | less, so they can

buy more. | d. | less, so they can buy less. |

|

|

|

11.

|

When taxes increase, consumption

a. | decreases as shown by a movement to the left along a given aggregate-demand

curve. | b. | decreases as shown by a shift of the aggregate demand curve to the

left. | c. | increases as shown by a movement to the right along a given aggregate-demand

curve. | d. | increases as shown by a shift of the aggregate demand curve to the

right. |

|

|

|

12.

|

When the money supply increases

a. | interest rates fall and so aggregate demand shifts right. | b. | interest rates fall

and so aggregate demand shifts left. | c. | interest rates rise and so aggregate demand

shifts right. | d. | interest rates rise and so aggregate demand shifts

left. |

|

|

|

13.

|

The discovery of a large amount of previously-undiscovered oil in the U.S. would

shift

a. | the long-run aggregate-supply curve to the right. | b. | the long-run

aggregate-supply curve to the left. | c. | the aggregate-demand curve to the

left. | d. | None of the above is correct. |

|

|

|

14.

|

Which of the following would cause prices to fall and output to rise in the

short run?

a. | Short-run aggregate supply shifts right. | b. | Short-run aggregate

supply shifts left. | c. | Aggregate demand shifts

right. | d. | Aggregate demand shifts left. |

|

|

|

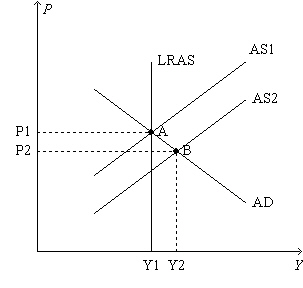

Figure 1.

|

|

|

15.

|

Refer to Figure 1. Starting from point B and assuming that

aggregate demand is held constant, in the long run the economy is likely to experience

a. | a falling price level and a falling level of output. | b. | a falling price

level and a rising level of output. | c. | a rising price level and a falling level of

output. | d. | a rising price level and a rising level of output. |

|

|

|

Optimism

Imagine that the economy is in long-run equilibrium. Then,

perhaps because of improved international relations and increased confidence in policy makers, people

become more optimistic about the future and stay this way for some time.

|

|

|

16.

|

Refer to Optimism. Which curve shifts and in which direction?

a. | aggregate demand shifts right | b. | aggregate demand shifts

left | c. | aggregate supply shifts right. | d. | aggregate supply shifts

left. |

|

|

|

17.

|

When production costs rise,

a. | the short-run aggregate supply curve shifts to the right. | b. | the short-run

aggregate supply curve shifts to the left. | c. | the aggregate demand curve shifts to the

right. | d. | the aggregate demand curve shifts to the left. |

|

|

|

18.

|

Which of the following will reduce the price level and real output in the short

run?

a. | an increase in the money supply | b. | an increase in oil prices | c. | a decrease in the

money supply | d. | technical progress |

|

|

|

19.

|

According to classical macroeconomic theory,

a. | output is determined by the supplies of capital and labor and the available

production technology. | b. | for any given level of output, the interest

rate adjusts to balance the supply of, and demand for, loanable funds. | c. | given output and the

interest rate, the price level adjusts to balance the supply of, and demand for,

money. | d. | All of the above are correct. |

|

|

|

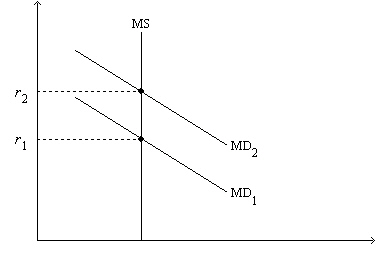

Figure 2. On the left-hand graph, MS represents the supply of money

and MD represents the demand for money; on the right-hand graph, AD represents aggregate

demand. The usual quantities are measured along the axes of both graphs. .  |  | | |

|

|

|

20.

|

Refer to Figure 2. Which of the following quantities is held

constant as we move from one point to another on either graph?

a. | the nominal interest rate | b. | the quantity of money

demanded | c. | investment | d. | the expected rate of

inflation |

|

|

|

21.

|

Refer to Figure 2. If the money-supply curve MS on the left-hand

graph were to shift to the right, this would

a. | represent an action taken by the Federal Reserve. | b. | shift the AD curve

to the left. | c. | create, until the interest rate adjusted, an excess demand for money at the interest

rate that equilibrated the money market before the shift. | d. | All of the above are

correct. |

|

|

|

22.

|

If, at some interest rate, the quantity of money demanded is greater than the

quantity of money supplied, people will desire to

a. | sell interest-bearing assets, causing the interest rate to

decrease. | b. | sell interest-bearing assets, causing the interest rate to

increase. | c. | buy interest-bearing assets, causing the interest rate to

decrease. | d. | buy interest-bearing assets, causing the interest rate to

increase. |

|

|

|

23.

|

A decrease in the interest rate could have been caused by the money-demand curve

shifting

a. | leftward because the price level fell. | b. | leftward because the price level

rose | c. | rightward because the price level fell. | d. | rightward because

the price level rose. |

|

|

|

24.

|

Other things equal, in the short run a higher price level leads households

to

a. | increase consumption and firms to buy more capital goods. | b. | increase consumption

and firms to buy fewer capital goods. | c. | decrease consumption and firms to buy more

capital goods. | d. | decrease consumption and firms to buy fewer capital

goods. |

|

|

|

25.

|

The most important reason for the slope of the aggregate-demand curve is that as

the price level

a. | increases, interest rates increase, and investment decreases. | b. | increases, interest

rates decrease, and investment increases. | c. | decreases, interest rates increase, and

investment increases. | d. | decreases, interest rates decrease, and

investment decreases. |

|

|

|

26.

|

Fiscal policy refers to the idea that aggregate demand is affected by changes

in

a. | the money supply. | b. | government spending and

taxes. | c. | trade policy. | d. | All of the above are

correct. |

|

|

|

27.

|

The logic of the multiplier effect applies

a. | only to changes in government spending. | b. | to any change in

spending on any component of GDP. | c. | only to changes in the money

supply. | d. | only when the crowding-out effect is sufficiently

strong. |

|

|

|

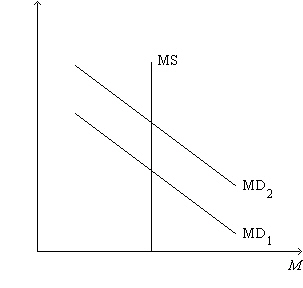

Figure 3. On the figure, MS represents money supply and MD

represents money demand.

|

|

|

28.

|

Refer to Figure 3. What is measured along the vertical axis of the

graph?

a. | the quantity of output | b. | the amount of crowding out | c. | the interest

rate | d. | the price level |

|

|

|

29.

|

The multiplier effect is exemplified by the multiplied impact on

a. | the money supply of a given increase in government purchases. | b. | tax revenues of a

given increase in government purchases. | c. | investment of a given increase in interest

rates. | d. | aggregate demand of a given increase in government

purchases. |

|

|

|

30.

|

As income rises

a. | money demand rises, so the interest rate rises. | b. | money demand rises,

so the interest rate falls | c. | money demand falls, so the interest rate

rises. | d. | money demand falls, so the interest rate falls. |

|

|

|

31.

|

Permanent tax cuts shift the AD curve

a. | farther to the right than do temporary tax cuts. | b. | not as far to the

right as do temporary tax cuts. | c. | farther to the left than do temporary tax

cuts. | d. | not as far to the left as do temporary tax cuts. |

|

|

|

32.

|

An increase in government spending on goods to build or repair

infrastructure

a. | shifts the aggregate demand curve to the right. | b. | has a multiplier

effect. | c. | shifts the aggregate supply curve to the right, but this effect is likely more

important in the long run. | d. | All of the above are

correct. |

|

|

|

33.

|

A reduction in U.S net exports would shift U.S. aggregate demand

a. | rightward. In an attempt to stabilize the economy, the government could raise

taxes. | b. | rightward. In an attempt to stabilize the economy, the government could cut

taxes. | c. | leftward. In an attempt to stabilize the economy, the government could raise

taxes. | d. | leftward. In an attempt to stabilize the economy, the government could cut

taxes. |

|

|

|

34.

|

During recessions, taxes tend to

a. | rise and thereby increase aggregate demand. | b. | rise and thereby

decrease aggregate demand. | c. | fall and thereby increase aggregate

demand. | d. | fall and thereby decrease aggregate demand. |

|

|

|

35.

|

The primary argument against active monetary and fiscal policy is that

a. | attempts to stabilize the economy do not constitute a proper role for government in a

democratic society. | b. | these policies affect the economy with a long

lag. | c. | these policies affect the economy too quickly and with too much

impact. | d. | history demonstrates that interest rates respond unpredictably to active policies,

leading to unpredictable effects on income. |

|

|

|

36.

|

Phillips found a negative relation between

a. | output and unemployment. | b. | output and employment. | c. | wage inflation and

unemployment. | d. | None of the above is correct. |

|

|

|

37.

|

If policymakers decrease aggregate demand, then in the short run the price

level

a. | falls and unemployment rises. | b. | and unemployment fall. | c. | and unemployment

rise. | d. | rises and unemployment falls. |

|

|

|

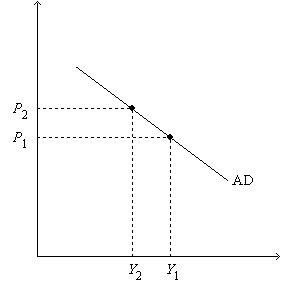

Figure 4. The left-hand graph shows a short-run aggregate-supply

(SRAS) curve and two aggregate-demand (AD) curves. On the right-hand diagram, U represents the

unemployment rate.

|

|

|

38.

|

Refer to Figure 4. What is measured along the vertical axis of the

right-hand graph?

a. | the interest rate | b. | the inflation rate | c. | the wage

rate | d. | the growth rate of the nominal money supply |

|

|

|

39.

|

By raising aggregate demand more than anticipated, policymakers

a. | reduce unemployment for awhile. | b. | raise unemployment for

awhile. | c. | reduce unemployment permanently. | d. | None of the above is

correct. |

|

|

|

40.

|

If the Federal Reserve increases the rate at which it increases the money

supply, then unemployment is lower

a. | in the long run and the short run. | b. | in the long run but not the short

run. | c. | in the short run but not the long run. | d. | in neither the short run nor the long

run. |

|

|

|

41.

|

In the long run an increase in the money supply growth rate effects

a. | the inflation rate and the natural rate of unemployment. | b. | the inflation rate,

but not the natural rate of unemployment. | c. | neither the inflation rate nor the natural rate

of unemployment. | d. | the natural rate of unemployment, but not the inflation

rate. |

|