Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

1.

|

If M = 3,000, P = 2, and Y = 12,000, what is

velocity?

|

|

|

2.

|

When the price level rises, the number of dollars needed to buy a representative

basket of goods

a. | increases, and so the value of money rises. | b. | increases, and so

the value of money falls. | c. | decreases, and so the value of money

rises. | d. | decreases, and so the value of money falls |

|

|

|

3.

|

When the money market is drawn with the value of money on the vertical axis, as

the price level increases, the value of money

a. | increases, so the quantity of money demanded increases. | b. | increases, so the

quantity of money demanded decreases. | c. | decreases, so the quantity of money demanded

decreases. | d. | decreases, so the quantity of money demanded

increases. |

|

|

|

4.

|

The price level falls. This might be because the Federal Reserve

a. | bought bonds which raised the money supply. | b. | bought bonds which

reduced the money supply. | c. | sold bonds which raised the money

supply. | d. | sold bonds which reduced the money supply. |

|

|

|

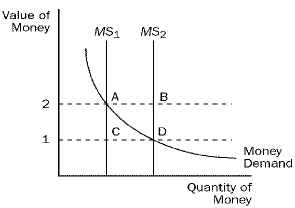

Figure 1

|

|

|

5.

|

Refer to Figure 1. If the current money supply is MS1,

then

a. | there is no excess supply or excess demand if the value of money is

2. | b. | the equilibrium is at point C. | c. | there is an excess supply of money if the value

of money is 1. | d. | None of the above is correct. |

|

|

|

6.

|

Economic variables whose values are measured in goods are called

a. | dichotomous variables. | b. | nominal variables. | c. | classical

variables. | d. | real variables. |

|

|

|

7.

|

Velocity is computed as

a. | (P  Y)/M. Y)/M. | b. | (P  M)/Y.

M)/Y. | c. | (Y  M)/P.

M)/P. | d. | (Y  M)/V.

M)/V. |

|

|

|

8.

|

According to the assumptions of the quantity theory of money, if the money

supply increases by 5 percent, then

a. | nominal and real GDP would rise by 5 percent. | b. | nominal GDP would

rise by 5 percent; real GDP would be unchanged. | c. | nominal GDP would be unchanged; real GDP would

rise by 5 percent. | d. | neither nominal GDP nor real GDP would

change. |

|

|

|

9.

|

Based on past experience, if a country is experiencing hyperinflation, then

which of the following would be a reasonable guess?

a. | The country has high money supply growth. | b. | Inflation is acting

like a tax on everyone who holds money. | c. | The government is printing money to finance its

expenditures. | d. | All of the above are correct. |

|

|

|

10.

|

Printing money to finance government expenditures

a. | causes the value of money to rise. | b. | imposes a tax on everyone who holds

money. | c. | is the principal method by which the U.S. government finances its

expenditures. | d. | None of the above is correct. |

|

|

|

11.

|

The Fisher effect says that

a. | the nominal interest rate adjusts one for one with the inflation

rate. | b. | the growth rate of the money supply is negatively related to the velocity of

money. | c. | real variables are heavily influenced by the monetary system. | d. | All of the above are

correct. |

|

|

|

12.

|

The shoeleather cost of inflation refers to

a. | the redistributional effects of unexpected inflation. | b. | the time spent

searching for low prices when inflation rises. | c. | the waste of resources used to maintain lower

money holdings. | d. | the increased cost to the government of printing more

money. |

|

|

|

13.

|

The costs of changing price tags and price listings are known as

a. | inflation-induced tax distortions. | b. | relative-price variability

costs. | c. | shoeleather costs. | d. | menu costs. |

|

|

|

14.

|

Wealth is redistributed from creditors to debtors when inflation was expected to

be

a. | high and it turns out to be high. | b. | low and it turns out to be

low. | c. | low and it turns out to be high. | d. | high and it turns out to be

low. |

|

|

|

15.

|

Net exports of a country are the value of

a. | goods and services imported minus the value of goods and services

exported. | b. | goods and services exported minus the value of goods and services

imported. | c. | goods exported minus the value of goods imported. | d. | goods imported minus

the value of goods exported. |

|

|

|

16.

|

Which of the following both raise net exports?

a. | exports rise, imports rise | b. | exports rise, imports fall | c. | imports rise,

exports rise | d. | imports rise, exports fall |

|

|

|

17.

|

Net capital outflow measures

a. | foreign assets held by domestic residents minus domestic assets held by foreign

residents. | b. | the imbalance between the amount of foreign assets bought by domestic residents and

the amount of domestic assets bought by foreigners. | c. | the imbalance between the amount of foreign

assets bought by domestic residents and the amount of domestic goods and services sold to

foreigners. | d. | None of the above is correct. |

|

|

|

18.

|

When Microsoft establishes a distribution center in France, U.S. net capital

outflow

a. | increases because Microsoft makes a portfolio investment in

France. | b. | decreases because Microsoft makes a portfolio investment in

France. | c. | increases because Microsoft makes a direct investment in capital in

France. | d. | decreases because Microsoft makes a direct investment in capital

France. |

|

|

|

19.

|

Which of the following is always correct?

a. | Y - I = NCO | b. | NCO = NX | c. | NX =

I | d. | All of the above are correct. |

|

|

|

20.

|

A U.S. firm exchanges dollars for yen and then uses them to buy Japanese

goods. Overall as a result of these transactions

a. | both U.S. net capital outflow and U.S. net exports rise. | b. | both U.S. net

capital outflow and U.S. net exports fall. | c. | U.S. net capital outflow rises and U.S. net

exports fall. | d. | U.S. net capital outflow falls and U.S. net exports

rise. |

|

|

|

21.

|

If a country has business opportunities that are relatively attractive to other

countries, we would expect it to have

a. | both positive net exports and positive net capital outflow. | b. | both negative net

exports and negative net capital outflow. | c. | positive net exports and negative net capital

outflow. | d. | negative net exports and positive net capital

outflow. |

|

|

|

22.

|

A country has $45 million of domestic investment and net capital outflow of -$60

million. What is its saving?

a. | $15 million. | b. | -$15 million. | c. | $105

million. | d. | -$105 million. |

|

|

|

23.

|

The country of Sylvania has a GDP of $900, investment of $200, government

purchases of $200, and net capital outflow of -$100. What is consumption?

|

|

|

24.

|

If the exchange rate were .8 Canadian dollars per U.S. dollar, a watch that

costs $8 US dollars would cost

a. | 6.4 Canadian dollars. | b. | 10 Canadian dollars. | c. | 12.50 Canadian

dollars. | d. | None of the above is correct. |

|

|

|

25.

|

When a country's central bank increases the money supply, a unit of

money

a. | gains value both in terms of the domestic goods and services it can buy and in terms

of the foreign currency it can buy. | b. | gains value in terms of the domestic goods and

services it can buy, but loses value in terms of the foreign currency it can buy. | c. | loses value in terms

of the domestic goods and services it can buy, but gains value in terms of the foreign currency it

can buy. | d. | loses value both in terms of the domestic goods and services it can buy and in terms

of the foreign currency it can buy. |

|

|

|

26.

|

According to purchasing-power parity, if prices in the United States increase by

a smaller percentage than prices in Poland, then

a. | the real exchange defined as Polish goods per unit of U.S. goods

rises. | b. | the real exchange defined as Polish goods per unit of U.S. goods

falls. | c. | the nominal exchange rate defined as Polish currency per dollar

rises. | d. | the nominal exchange rate defined as Polish currency per dollar

falls. |

|

|

|

27.

|

Purchasing-power parity theory does not hold at all times because

a. | many goods are not easily transported. | b. | the same goods produced in different countries

may be imperfect substitutes for each other. | c. | Both a and b are correct. | d. | prices are different

across countries. |

|

|

|

28.

|

Over the past two decades, the United States has

a. | generally had, or been very near to a trade balance. | b. | had trade deficits

in about as many years as it has trade surpluses. | c. | persistently had a trade

deficit. | d. | persistently had a trade surplus. |

|

|

|

29.

|

In the open-economy macroeconomic model, the supply of loanable funds comes

from

a. | national saving. | b. | private saving. | c. | domestic

investment. | d. | the sum of domestic investment and net capital

outflow. |

|

|

|

30.

|

In an open economy, the demand for loanable funds comes from

a. | only those who want to borrow funds to buy domestic capital

goods. | b. | only those who want to borrow funds to buy foreign assets. | c. | those who want to

borrow funds to buy either domestic capital goods or foreign assets. | d. | neither those who

want to borrow funds to buy domestic capital goods nor those who want to borrow funds to buy foreign

assets. |

|

|

|

31.

|

In the open-economy macroeconomic model, the supply of loanable funds

equals

a. | national saving. The demand for loanable funds comes from domestic investment + net

capital outflow. | b. | national saving. The demand for loanable funds comes only from domestic

investment. | c. | private saving. The demand for loanable funds comes from domestic investment + net

capital outflow. | d. | private saving. The demand for loanable funds comes only from domestic

investment. |

|

|

|

32.

|

If the demand for loanable funds shifts right, then

a. | the real interest rate and the equilibrium quantity of loanable funds both

fall. | b. | the real interest rate falls and the equilibrium quantity of loanable funds

rises. | c. | the real interest rate and the equilibrium quantity of loanable funds both

rise. | d. | the real interest rate rises and the equilibrium quantify of loanable funds

falls. |

|

|

|

33.

|

In an open economy,

a. | net capital outflow = imports. | b. | net capital outflow = net

exports. | c. | net capital outflow = exports. | d. | None of the above is

correct. |

|

|

|

34.

|

In the open economy macroeconomic model, the amount of dollars demanded in the

market for foreign-currency exchange at a given real exchange rate increases if

a. | either U.S. imports or exports increase. | b. | either U.S. imports

or exports decrease. | c. | either U.S. imports increase or U.S. exports

decrease. | d. | either U.S. imports decrease or U.S. exports

increase. |

|

|

|

35.

|

The variable that links the market for loanable funds and the market for

foreign-currency exchange is

a. | net capital outflow. | b. | national saving. | c. | exports. | d. | domestic

investment. |

|

|

|

36.

|

U.S. net capital outflow

a. | is a source of the supply of loanable funds, and the source of the supply of dollars

in the foreign exchange market. | b. | is a source of the supply of loanable funds,

and a source of the demand for dollars in the foreign exchange market. | c. | is a part of the

demand for loanable funds, and the source of the supply of dollars in the foreign exchange

market. | d. | is a part of the demand for loanable funds, and a source of the demand for dollars in

the foreign exchange market. |

|

|

|

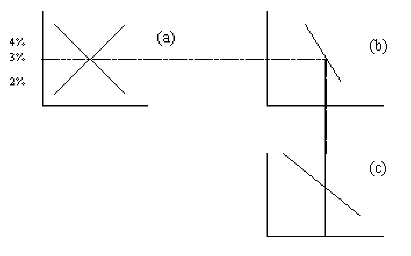

Figure 2

Refer to this diagram to answer the questions

below.

|

|

|

37.

|

Refer to Figure 2. The curve in panel b shows that as the interest rate

rises,

a. | domestic investment declines. | b. | net capital outflow

declines. | c. | net capital outflow and domestic investment decline. | d. | None of the above is

correct. |

|

|

|

38.

|

Refer to Figure 3. Which curve shows the relation between the exchange

rate and net exports?

a. | the demand curve in panel a. | b. | the demand curve in panel

c. | c. | the supply curve in panel a. | d. | the supply curve in panel

c. |

|

|

|

39.

|

A government budget deficit

a. | increases both net capital outflow and net exports. | b. | decreases both net

capital outflow and net exports. | c. | increases net capital outflow and decreases net

exports. | d. | decreases net capital outflow and increases net

exports. |

|

|

|

40.

|

Trade policies

a. | alter the trade balance because they alter imports of the country that implemented

them. | b. | alter the trade balance because they alter net capital outflow of the country that

implemented them. | c. | do not alter the trade balance because they

cannot alter the national saving or domestic investment of the country that implements

them. | d. | do not alter the trade balance because they cannot alter the real exchange rate of

the currency of the country that implements them. |

|