Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

1.

|

To fully understand how taxes affect economic well-being, we must compare the

a. | benefit to buyers with the loss to sellers. | b. | price paid by buyers

to the price received by sellers. | c. | profits earned by firms to the losses incurred

by consumers. | d. | decrease in total surplus to the increase in revenue raised by the

government. |

|

|

|

2.

|

The benefit that government receives from a tax is measured by

a. | the change in the equilibrium quantity of the good. | b. | the change in the

equilibrium price of the good. | c. | tax revenue. | d. | total

surplus. |

|

|

|

3.

|

Taxes cause deadweight losses because they

a. | lead to losses in surplus for consumers and for producers that, when taken together,

exceed tax revenue collected by the government. | b. | distort incentives to both buyers and

sellers. | c. | prevent buyers and sellers from realizing some of the gains from

trade. | d. | All of the above are correct. |

|

|

|

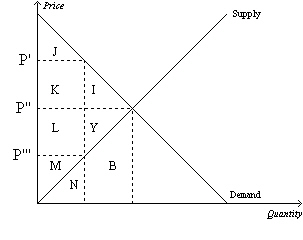

Figure 1

|

|

|

4.

|

Refer to Figure 1. Suppose the government imposes a tax of P’

- P’’’. The producer surplus after the tax is measured by the area

a. | M. | b. | L+M+N+Y+B. | c. | L+M+Y. | d. | J. |

|

|

|

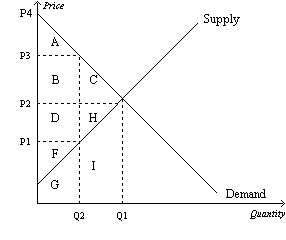

Figure 2

Suppose that the government imposes a tax of P3 -

P1.

|

|

|

5.

|

Refer to Figure 2. The benefit to the government is measured by

a. | tax revenue and is represented by area A+B. | b. | tax revenue and is

represented by area B+D. | c. | the net gain in total surplus and is

represented by area B+D. | d. | the net gain in total surplus and is

represented by area C+H. |

|

|

|

6.

|

Refer to Figure 2. The loss in total welfare that results from the tax is

represented by area

a. | A+B+D+F. | b. | A+B+C. | c. | D+H+F. | d. | C+H. |

|

|

|

7.

|

With which of the Ten Principles of Economics is the study of

international trade most closely connected?

a. | People face tradeoffs. | b. | Trade can make everyone better

off. | c. | Governments can sometimes improve market outcomes. | d. | Prices rise when the

government prints too much money. |

|

|

|

8.

|

Which of the following tools and concepts is useful in the analysis of

international trade?

a. | total surplus | b. | domestic supply | c. | equilibrium

price | d. | All of the above are correct. |

|

|

|

9.

|

What is the fundamental basis for trade among nations?

a. | shortages or surpluses in nations that do not trade | b. | misguided economic

policies | c. | absolute advantage | d. | comparative

advantage |

|

|

|

10.

|

Assume, for the U.S., that the domestic price of beef without international

trade is lower than the world price of beef. This suggests that, in the production of beef,

a. | the U.S. has a comparative advantage over other countries and the U.S. will export

beef. | b. | the U.S. has a comparative advantage over other countries and the U.S. will import

beef. | c. | other countries have a comparative advantage over the U.S. and the U.S. will export

beef. | d. | other countries have a comparative advantage over the U.S. and the U.S. will import

beef. |

|

|

|

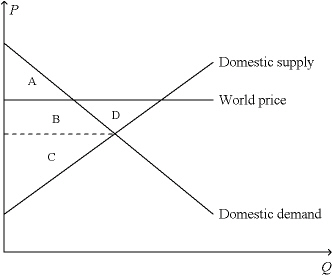

Figure 3. On the diagram below, Q represents the quantity

of computers and P represents the price of computers.

|

|

|

11.

|

Refer to Figure 3. When the country for which the figure is drawn

allows international trade in computers,

a. | consumer surplus for domestic computer consumers decreases. | b. | the demand for

computers by domestic computer consumers decreases. | c. | the losses of the domestic losers outweigh the

gains of the domestic winners. | d. | domestic computer producers sell fewer

computers. |

|

|

|

12.

|

Aquilonia has decided to end its policy of not trading with the rest of the

world. When it ends its trade restrictions, it discovers that it is importing incense, exporting

steel, and neither importing nor exporting rugs. Which groups in Aquilonia are better off as a result

of the new free-trade policy?

a. | producers of incense and consumers of steel | b. | consumers of all

three goods | c. | consumers of incense and producers of rugs | d. | producers of steel

and consumers of incense |

|

|

|

13.

|

After a certain nation changed its policy from one that banned international

trade in wheat to one that allowed international trade in wheat, the nation began importing

wheat. As a result, total surplus in the wheat market increased by $10 million. Which of

the following changes could have occurred as well?

a. | The price of wheat in that nation increased with the adoption of the new

policy. | b. | The domestic quantity of wheat supplied increased with the adoption of the new

policy. | c. | Consumer surplus in the wheat market increased by $7 million and producer surplus in

the wheat market increased by $3 million. | d. | Consumer surplus in the wheat market increased

by $15 million and producer surplus in the wheat market decreased by $5

million. |

|

|

|

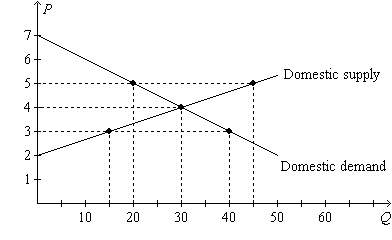

Figure 4. On the diagram below, Q represents the quantity of

peaches and P represents the price of peaches. The domestic country is Isoland.

|

|

|

14.

|

Refer to Figure 4. If Isoland allows international trade and the

world price of peaches is $5, then

a. | producer surplus will be smaller than it would be if Isoland banned

trade. | b. | consumer surplus will be smaller than it would be if Isoland banned

trade. | c. | the domestic quantity of peaches demanded will exceed the domestic quantity of

peaches supplied. | d. | Isoland will be an importer of

peaches. |

|

|

|

15.

|

The “unfair-competition” argument might be cited by an American who

believes that

a. | almost every country has a comparative advantage, relative to the United States, in

producing almost all goods. | b. | young industries should be protected against

foreign competition until they become profitable. | c. | the American automobile industry should be

protected against Japanese firms that are able to produce automobiles at relatively low

cost. | d. | the French government’s subsidies to French farmers justify restrictions on

American imports of French agricultural products. |

|

|

|

16.

|

Which of the following statements about GDP is correct?

a. | GDP measures two things at once: the total income of everyone in the economy and the

unemployment rate of the economy’s labor force. | b. | Money continuously flows from households to

government and then back to households, and GDP measures this flow of money. | c. | GDP is to a

nation’s economy as household income is to a household. | d. | All of the above are

correct. |

|

|

|

17.

|

Gross domestic product is defined as

a. | the quantity of all final goods and services demanded within a country in a given

period of time. | b. | the quantity of all final goods and services supplied within a country in a given

period of time. | c. | the market value of all final goods and services produced within a country in a given

period of time. | d. | Both (a) and (b) are correct. |

|

|

|

18.

|

Until recently, George lived in a home that was newly constructed in 2005.

In 2005, he paid $200,000 for the brand new house. He sold the house in 2006 for

$225,000. Which of the following statements is correct regarding the sale of the house?

a. | The 2006 sale increased 2006 GDP by $225,000 and had no effect on 2005

GDP. | b. | The 2006 sale increased 2006 GDP by $25,000 and had no effect on 2005

GDP. | c. | The 2006 sale increased 2006 GDP by $225,000; furthermore, the 2006 sale caused 2005

GDP to be revised upward by $25,000. | d. | The 2006 sale affected neither 2005 GDP nor

2006 GDP. |

|

|

|

19.

|

Which of the following examples of production of goods and services would be

included in U.S. GDP?

a. | Samantha, a Canadian citizen, grows sweet corn in Minnesota and sells it to a grocery

store in Canada. | b. | Ian, an American citizen, grows peaches for his family in the back yard of their

Atlanta home. | c. | Leo, an American citizen, grows marijuana in his Seattle home and sells it to his

friends and neighbors. | d. | None of the above examples of production would

be included in U.S. GDP. |

|

|

|

20.

|

Which of the following examples of household spending is categorized as

investment rather than consumption?

a. | expenditures on durable goods such as automobiles and

refrigerators | b. | expenditures on intangibles items such as medical care | c. | expenditures on new

housing | d. | All of the above are correct. |

|

|

|

21.

|

Which of the following components or subcomponents of GDP can be either positive

or negative?

a. | consumers' spending on durable goods | b. | firms' spending

on capital equipment | c. | net exports | d. | All of the above are

correct. |

|

|

|

22.

|

In the economy of Wrexington in 2008, consumption was $1000, exports were $100,

government purchases were $450, imports were $150, and investment was $350. What was

Wrexington’s GDP in 2008?

a. | $1750 | b. | $1850 | c. | $1900 | d. | $2050 |

|

|

|

23.

|

The GDP deflator is the ratio of

a. | real GDP to nominal GDP multiplied by 100. | b. | real GDP to the

inflation rate multiplied by 100. | c. | nominal GDP to real GDP multiplied by

100. | d. | nominal GDP to the inflation rate multiplied by 100. |

|

|

|

24.

|

In the economy of Wrexington in 2008, real GDP was $5 trillion and the GDP

deflator was 200. What was Wrexington’s nominal GDP in 2008?

a. | $2.5 trillion | b. | $10 trillion | c. | $40

trillion | d. | $100 trillion |

|

|

|

25.

|

Suppose an economy produces only eggs and ham. In 2005, 100 dozen eggs are

sold at $3 per dozen and 50 pounds of ham are sold at $4 per pound. In 2004, the base year,

eggs sold at $1.50 per dozen and ham sold at $5 per pound. For 2005,

a. | nominal GDP is $400, real GDP is $500, and the GDP deflator is

80. | b. | nominal GDP is $400, real GDP is $500, and the GDP deflator is

125. | c. | nominal GDP is $500, real GDP is $400, and the GDP deflator is

80. | d. | nominal GDP is $500, real GDP is $400, and the GDP deflator is

125. |

|

|

|

26.

|

Many things that society values, such as good health, high-quality education,

enjoyable recreation opportunities, and desirable moral attributes of the population, are not

measured as part of GDP. It follows that

a. | GDP is not a useful measure of society's welfare. | b. | GDP is still a

useful measure of society's welfare because providing these other attributes is the

responsibility of government. | c. | GDP is still a useful measure of society's

welfare because it measures a nation's ability to purchase the inputs that can be used to help

produce the things that contribute to welfare. | d. | GDP is still the best measure of society's

welfare because these other values cannot actually be measured. |

|

|

|

27.

|

The information below was reported by the World Bank. On the basis of this

information, which list below contains the correct ordering of GDP per person from highest to

lowest? | Country | Nominal GDP in 2000 | Population in

2000 | | Kenya | $10,400 million | 30.1

million | | Tanzania | $9,000 million | 33.7

million | | Zimbabwe | $7,200 million | 12.6

million | | | |

a. | Kenya, Tanzania, Zimbabwe | b. | Tanzania, Kenya, Zimbabwe | c. | Zimbabwe, Kenya,

Tanzania | d. | Zimbabwe, Tanzania, Kenya |

|

|

|

28.

|

International data on GDP and socioeconomic variables

a. | are inconclusive about the relationship between GDP and the economic well-being of

citizens. | b. | suggest that poor nations actually might enjoy a higher standard of living than do

rich nations. | c. | leave no doubt that a nation's GDP is closely associated with its citizens'

standard of living. | d. | indicate that there are few real differences in

living standards around the world, in spite of the large differences in GDP between

nations. |

|

|

|

29.

|

The price index was 150 in the first year, 160 in the second year, and 175 in

the third year. The inflation rate was about

a. | 6.25 percent between the first and second years, and 8.6 percent between the second

and third years. | b. | 6.7 percent between the first and second years, and 9.4 percent between the second

and third years. | c. | 10 percent between the first and second years, and 15 percent between the second and

third years. | d. | 60 percent between the first and second years, and 75 percent between the second and

third years. |

|

|

|

Table 1

The table below pertains to Wrexington, an economy

in which the typical consumer’s basket consists of 20 pounds of meat and 10 toys. Year | Price of

Meat | Price of a

Toy | 2004 | $3 per

pound | $2 | 2005 | $1 per

pound | $7 | 2006 | $4 per

pound | $5 | | | |

|

|

|

30.

|

Refer to Table 1. The cost of the basket in 2006 was

a. | $9. | b. | $130. | c. | $140. | d. | $270. |

|

|

|

31.

|

In the basket of goods that is used to compute the consumer price index, the

three largest categories of consumer spending are

a. | housing, transportation, and recreation. | b. | housing,

transportation, and food & beverages. | c. | housing, food & beverages, and education

& communication. | d. | housing, medical care, and education &

communication. |

|

|

|

32.

|

The substitution bias in the consumer price index refers to the

a. | substitution by consumers toward new goods and away from old

goods. | b. | substitution by consumers toward a smaller number of high-quality goods and away from

a larger number of low-quality goods. | c. | substitution by consumers toward goods that

have become relatively less expensive and away from goods that have become relatively more

expensive. | d. | substitution of new prices for old prices in the CPI basket of goods and services

from one year to the next. |

|

|

|

33.

|

Laura bought word-processing software in 2005 for $50. Laura's twin

brother, Laurence, bought an upgrade of the same software in 2006 for $50. To which problem in

the construction of the CPI is this situation most relevant?

a. | substitution bias | b. | unmeasured quality change | c. | introduction of new

goods | d. | income bias |

|

|

|

34.

|

Which of these events would cause the consumer price index to overstate the

increase in the cost of living?

a. | Car makers benefit from a new technology that allows them to sell higher-quality cars

to consumers with no increase in price. | b. | Energy prices decrease, and consumers respond

by buying more gas and electricity. | c. | A new good is introduced that renders cellular

telephones inferior and obsolete. | d. | All of the above are

correct. |

|

|

|

35.

|

Two alternative measures of the overall level of prices are

a. | the inflation rate and the consumer price index. | b. | the inflation rate

and the GDP deflator. | c. | the GDP deflator and the consumer price

index. | d. | the cost of living index and nominal GDP. |

|

|

|

36.

|

In 1970, Professor Plum earned $12,000; in 1980, he earned $24,000; and in 1990,

he earned $36,000. If the CPI was 40 in 1970, 70 in 1980, and 130 in 1990, then in real terms,

Professor Plum's salary was highest in

a. | 1970 and lowest in 1980. | b. | 1970 and lowest in 1990. | c. | 1980 and lowest in

1970. | d. | 1980 and lowest in 1990. |

|

|

|

37.

|

Which of the following statements is correct about the relationship between the

nominal interest rate and the real interest rate?

a. | The real interest rate is the nominal interest rate times the rate of

inflation. | b. | The real interest rate is the nominal interest rate minus the rate of

inflation. | c. | The real interest rate is the nominal interest rate plus the rate of

inflation. | d. | The real interest rate is the nominal interest rate divided by the rate of

inflation. |

|

|

|

38.

|

If the nominal interest rate is 6 percent and the rate of inflation is 2

percent, then the real interest rate is

a. | -4 percent. | b. | 2 percent. | c. | 4

percent. | d. | 8 percent. |

|

|

|

39.

|

Suppose that over the past year, the real interest rate was 5 percent and the

inflation rate was 3 percent. It follows that

a. | the dollar value of savings increased at 5 percent, and the purchasing power of

savings increased at 2 percent. | b. | the dollar value of savings increased at 5

percent, and the purchasing power of savings increased at 8 percent. | c. | the dollar value of

savings increased at 8 percent, and the purchasing power of savings increased at 2

percent. | d. | the dollar value of savings increased at 8 percent, and the purchasing power of

savings increased at 5 percent. |

|

|

|

40.

|

Which of the following is correct?

a. | Nominal and real interest rates always move together. | b. | Nominal and real

interest rates never move together. | c. | Nominal and real interest rates do not always

move together. | d. | Nominal and real interest rates always move in opposite

directions. |

|