Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

1.

|

Which of the following is not a determinant of the price elasticity of

demand for a good?

a. | the time horizon | b. | the steepness or flatness of the supply curve

for the good | c. | the definition of the market for the good | d. | the availability of

substitutes for the good |

|

|

|

2.

|

If the price elasticity of demand is 1.5, regardless of which two points on the

demand curve are used to compute the elasticity, then

a. | demand is perfectly inelastic, and the demand curve is vertical. | b. | demand is elastic,

and the demand curve is a straight, downward-sloping line. | c. | demand is perfectly

elastic, and the demand curve is horizontal. | d. | demand is elastic, and the demand curve is

something other than a straight, downward-sloping line. |

|

|

|

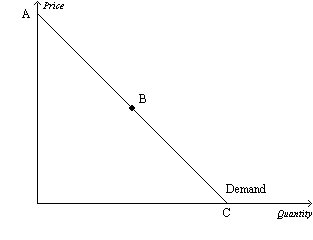

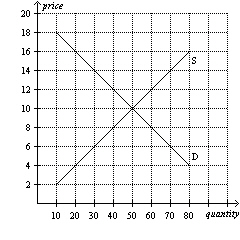

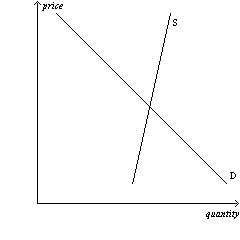

Figure 1

|

|

|

3.

|

Refer to Figure 1. The section of the demand curve from B to C represents

the

a. | elastic section of the demand curve. | b. | perfectly elastic section of the demand

curve. | c. | unit elastic section of the demand curve. | d. | inelastic section of

the demand curve. |

|

|

|

4.

|

Refer to Figure 1. If the price decreases in the region of the demand

curve between points A and B, we can expect total revenue to

a. | increase. | b. | stay the same. | c. | decrease. | d. | first decrease, then increase until total

revenue is maximized. |

|

|

|

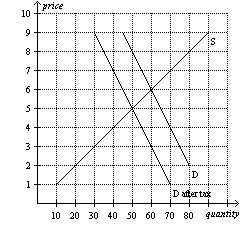

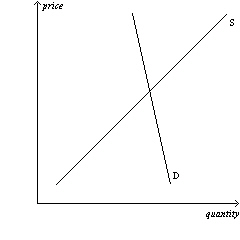

Figure 2

|

|

|

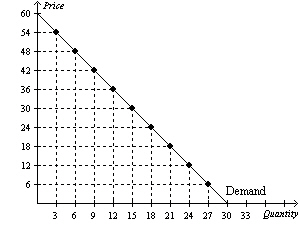

5.

|

Refer to Figure 2. Using the midpoint method, between prices of $12 and

$18, price elasticity of demand is

a. | 0.33. | b. | 0.67. | c. | 1.33. | d. | 1.89. |

|

|

|

6.

|

Suppose demand is perfectly elastic, and the supply of the good in question

decreases. As a result,

a. | the equilibrium quantity decreases, and the equilibrium price is

unchanged. | b. | the equilibrium price increases, and the equilibrium quantity is

unchanged. | c. | the equilibrium quantity and the equilibrium price both are

unchanged. | d. | buyers’ total expenditure on the good is

unchanged. |

|

|

|

7.

|

A perfectly inelastic demand implies that buyers

a. | decrease their purchases when the price rises. | b. | purchase the same

amount as before when the price rises or falls. | c. | increase their purchases only slightly when the

price falls. | d. | respond substantially to an increase in price. |

|

|

|

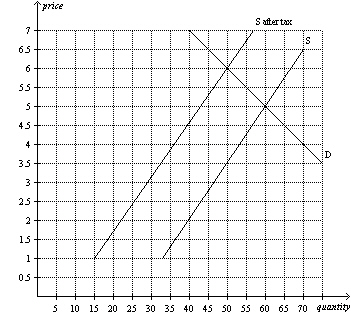

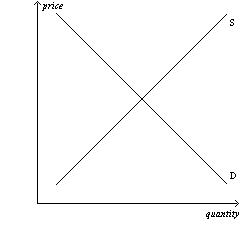

Figure 3

|

|

|

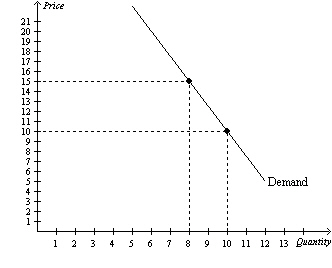

8.

|

Refer to Figure 3. A decrease in price from $15 to $10 leads to

a. | a decrease in total revenue of $10, so the price elasticity of demand is greater than

1 in this price range. | b. | a decrease in total revenue of $10, so the

price elasticity of demand is less than 1 in this price range. | c. | a decrease in total

revenue of $20, so the price elasticity of demand is less than 1 in this price

range. | d. | a decrease in total revenue of $20, so demand is elastic in this price

range. |

|

|

|

9.

|

You are in charge of the local city-owned golf course. You need to increase the

revenue generated by the golf course in order to meet expenses. The mayor advises you to increase the

price of a round of golf. The city manager recommends reducing the price of a round of golf. You

realize that

a. | the mayor thinks demand is elastic, and the city manager thinks demand is

inelastic. | b. | both the mayor and the city manager think that demand is elastic. | c. | both the mayor and

the city manager think that demand is inelastic. | d. | the mayor thinks demand is inelastic, and the

city manager thinks demand is elastic. |

|

|

|

10.

|

Eric produces jewelry boxes. If the demand for jewelry boxes is elastic and Eric

wants to increase his total revenue, he should

a. | increase the price of his jewelry boxes. | b. | decrease the price

of his jewelry boxes. | c. | not change the price of his jewelry

boxes. | d. | None of the above answers is correct. |

|

|

|

11.

|

The price elasticity of supply measures how responsive

a. | sellers are to a change in price. | b. | sellers are to a change in buyers'

income. | c. | buyers are to a change in production costs. | d. | equilibrium price is

to a change in supply. |

|

|

|

12.

|

When a supply curve is relatively flat,

a. | sellers are not at all responsive to a change in price. | b. | the equilibrium

price changes substantially when the demand for the good changes. | c. | the supply is

relatively elastic. | d. | the supply is relatively

inelastic. |

|

|

|

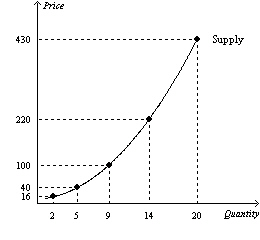

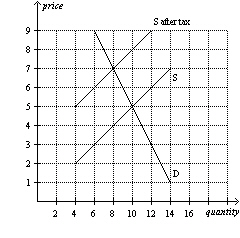

Figure 4The following figure shows the supply curve for a

particular good.

|

|

|

13.

|

Refer to Figure 4. Using the midpoint method, what is the price

elasticity of supply between $100 and $220?

|

|

|

14.

|

If a nonbinding price ceiling is imposed on a market, then

a. | the quantity sold in the market will decrease. | b. | the quantity sold in

the market will stay the same. | c. | the price in the market will

increase. | d. | the price in the market will decrease. |

|

|

|

15.

|

If a binding price ceiling is imposed on the computer market, then

a. | the quantity of computers demanded will increase. | b. | the quantity of

computers supplied will decrease. | c. | a shortage of computers will

develop. | d. | All of the above are correct. |

|

|

|

16.

|

In the housing market, rent control causes

a. | quantity supplied and quantity demanded to fall. | b. | quantity supplied to

fall and quantity demanded to rise. | c. | quantity supplied to rise and quantity demanded

to fall. | d. | quantity supplied and quantity demanded to rise. |

|

|

|

17.

|

Suppose the government has imposed a price floor on televisions. Which of

the following events could transform the price floor from one that is not binding into one that is

binding?

a. | Firms expect the price of televisions to rise in the future. | b. | The number of firms

selling televisions decreases. | c. | Consumers' income decreases, and

televisions are a normal good. | d. | The number of consumers buying televisions

increases. |

|

|

|

18.

|

If the minimum wage exceeds the equilibrium wage, then

a. | the quantity demanded of labor will exceed the quantity supplied. | b. | the quantity

supplied of labor will exceed the quantity demanded. | c. | the minimum wage will not be

binding. | d. | there will be no unemployment. |

|

|

|

Table 1Price | Quantity

Demanded | Quantity

Supplied | $0 | 12 | 0 | $1 | 10 | 2 | $2 | 8 | 4 | $3 | 6 | 6 | $4 | 4 | 8 | $5 | 2 | 10 | $6 | 0 | 12 | | | |

|

|

|

19.

|

Refer to Table 1. Suppose the government imposes a price ceiling of

$1 on this market. What will be the size of the shortage in this market?

a. | 0 units | b. | 2 units | c. | 8

units | d. | 10 units |

|

|

|

Table 2Price | Quantity

Demanded | Quantity

Supplied | $0 | 250 | 0 | $5 | 200 | 75 | $10 | 150 | 150 | $15 | 100 | 225 | $20 | 50 | 300 | $25 | 0 | 375 | | | |

|

|

|

20.

|

Refer to Table 2. Which of the following statements is

correct?

a. | A price ceiling set at $15 will be binding and will result in a shortage of 50

units. | b. | A price ceiling set at $15 will be binding and will result in a shortage of 100

units. | c. | A price ceiling set at $15 will be binding and will result in a shortage of 125

units. | d. | A price ceiling set at $15 will not be binding. |

|

|

|

Figure 5

|

|

|

21.

|

Refer to Figure 5. Which of the following price floors would be

binding in this market?

|

|

|

22.

|

Refer to Figure 5. If the government imposes a price ceiling of $8

on this market, then there will be a

a. | shortage of 0. | b. | shortage of 10. | c. | shortage of

20. | d. | shortage of 40. |

|

|

|

23.

|

If a tax is levied on the buyers of a product, then the supply curve

a. | will not shift. | b. | will shift up. | c. | will shift

down. | d. | will become flatter. |

|

|

|

24.

|

When a tax is imposed on the buyers of a good, the demand curve shifts

a. | upward by the amount of the tax. | b. | downward by the amount of the

tax. | c. | upward by less than the amount of the tax. | d. | downward by less

than the amount of the tax. |

|

|

|

25.

|

A tax on the buyers of popcorn

a. | increases the size of the popcorn market. | b. | decreases the size

of the popcorn market. | c. | has no effect on the size of the popcorn

market. | d. | may increase, decrease, or have no effect on the size of the popcorn

market. |

|

|

|

26.

|

The price paid by buyers in a market will decrease if the government

a. | increases a binding price floor in that market. | b. | increases a binding

price ceiling in that market. | c. | decreases a tax on the good sold in that

market. | d. | More than one of the above is correct. |

|

|

|

Figure 6

|

|

|

27.

|

Refer to Figure 6. The equilibrium price in the market before the

tax is imposed is

|

|

|

Figure 7

|

|

|

28.

|

Refer to Figure 7. The amount of the tax per unit is

a. | $1. | b. | $1.50. | c. | $2.50. | d. | $3.50. |

|

|

|

Figure 8

|

|

|

29.

|

Refer to Figure 8. The price paid by buyers after the tax is

imposed is

|

|

|

30.

|

Suppose that a tax is placed on books. If the sellers pay the majority of

the tax, then we know that the

a. | demand is more inelastic than the supply. | b. | supply is more

inelastic than the demand. | c. | government has required that buyers remit the

tax payments. | d. | government has required that sellers remit the tax

payments. |

|

|

|

Figure 6-16

Panel (a) | Panel (b) | | | |  |  | Panel (c) |  | | | | |

|

|

|

31.

|

Refer to Figure 6-16. In which market will the majority of the tax

burden fall on sellers?

a. | market (a) | b. | market (b) | c. | market

(c) | d. | All of the above are correct. |

|

|

|

32.

|

On a graph, the area below a demand curve and above the price measures

a. | producer surplus. | b. | consumer surplus. | c. | deadweight

loss. | d. | willingness to pay. |

|

|

|

33.

|

Suppose Katie, Kendra, and Kristen each purchase a particular type of cell phone

at a price of $80. Katie’s willingness to pay was $100, Kendra’s willingness to pay was

$95, and Kristen's willingness to pay was $80. Which of the following statements is

correct?

a. | For the three individuals together, consumer surplus amounts to

$35. | b. | Having bought the cell phone, Kristen is better off than she would have been had she

not bought it. | c. | Had the price of the cell phone been $95 rather than $80, Katie and Kendra definitely

would have been buyers and Kristen definitely would not have been a buyer. | d. | The fact that all

three individuals paid $80 for the same type of cell phone indicates that each one placed the same

value on that cell phone. |

|

|

|

34.

|

Carla would be willing to pay $500 to see Shakira, but she buys a ticket for

$200. Calra values the performance at

a. | $200. | b. | $300. | c. | $500. | d. | $800. |

|